Budgeting with the 50 / 30 / 20 Rule

- Bradford Financial Advisors

- Jul 25, 2022

- 4 min read

Updated: Mar 27, 2023

Remember the days of your mom and dad sitting at the kitchen table with a calculator and scratch paper? Mom may have very well ringing her hands while dad was trying to keep his cool knowing there were young ears present. More than likely, they were sorting through bills and trying to figure out how to rob Peter to pay Paul.

If this sounds like you, welcome to Americana! More than not that little rectangular card played a part in the equation. Interest on credit cards play a part in ratcheting up household debt that makes it difficult to get ahead. If you put a pencil to the APR you’ve paid over a lifetime, the total would be astounding and difficult to stomach. Back to Americana: Credit cards are too easy to use and we view availability of credit as a badge of honor. The fact is we accumulate more staggering debt than any country on the planet due to the accessibility of credit. Factor that with mortgage, rent, utilities, insurance, auto payments, medical bills, etc., you get the full picture of why there was so much stress for your parents trying to make ends meet on a monthly basis.

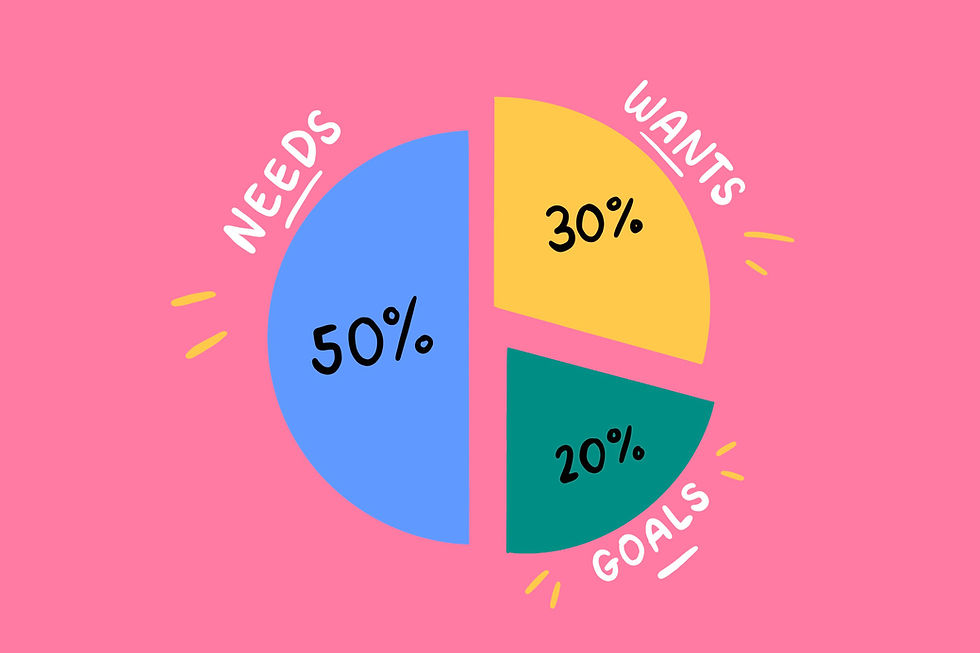

The good news is, you can break the cycle now! Whether you’re single or have dependents, you have a formula at your fingertips to avoid those stressful times. The only ingredient is discipline. Sure, easier said than done right? Budgeting is 90% behavior and 10% knowledge. Since we want get into the complexity of psychology, lets delve into the simplicity of the 10%. At the end of your reading, you will concentrate on three simple numbers: 50, 30 and 20. These digits represent the freedom you’ll have creating savings, the money you’ve earned to keep, and your cost of living each month. This is your new rule of law that is tried and true. If you work it properly, the cycle of debt, worry and distress can be broken.

50/30/20 Rule defined

Divide your after-tax income into three spending categories: 50% for needs and essentials, 30% for wants and 20% for savings and wiping out debt. You will know where every dollar goes. You worked hard for that money and this will efficiently help you not to stress when you spend. If you’ve asked yourself, “why can’t I save more?” You are reading this for a reason and you’ve grown weary of being sick and tired.

Origin of 50/30/20

It stems from book called, “All Your Worth: The Ultimate Lifetime Money Plan.” After twenty years of hard research, the conclusion is you don’t need a complex budget to keep you finances in good order.

50/30/20 How to

Needs are expenses you can’t avoid-payments for all essentials that would be difficult to live without. 50% of your after-tax income should cover most necessary costs.

The Needs:

Rent

Electricity and gas bill

Transportation

Insurances

Minimum loan repayments

Groceries

For example, if your monthly after-tax income is $2000. $1000 should be allocated to your needs.

The Wants

30% covers the fun stuff so you’re not feeling deprived.

Eating out

Clothes shopping

Holidays

Gym Membership

Entertainment

Groceries and other essentials

If you find you’re spending too much on cable subscriptions, think about eliminating some. If you’re grappling on whether it’s a need or want? Ask yourself, “Can I live without this?” You’ll usually feel it in your gut.

Keeping What’s Mine

Here’s the fun part! The 50 and thirty are squared away and the 20 will help you achieve your goals of saving, paying back debt. Consistently putting aside 20% of your pay each month will help you build emergency fund, developing long-term financial plan and have the juice to fuel that down payment on your first home or dream home. If you bring home $2000 after tax, you’ll put $400 back and within a year you’ll saved up nearly $5000. Sweet!

Apply Rinse and Repeat

Here’s how it works.

1. Calculate your after-tax income: If you are a freelancer or contract employee, your after-tax income will be what you earn each month, minus business expenses and amount you’ve set aside for taxes. (Be diligent on accounting your taxes as it is a big bite in the backside not having at the end of the year) If you’re an employee with steady paycheck on weekly or bi-weekly basis, this will be easier. Be mindful of declaring dependents as it will have an effect on your tax liability. Better to pay more now than owing in the end.

2. Categorize your spending for the last month: Utilize last month’s banking statement. Split all expenses into three categories: Needs, wants and savings. Remember a want is a luxury you can do without. This is a very important determination as it will affect the success of your plan. Your needs are non-negotiable! You worked to dang hard not to have savings in your account as well. That is your reward! Look over last month’s statement very carefully. If you’re married or have a partner, have a sit down and review the last month together. It will be eye opening on just how earnings just slipped away. Don’t fret though as you’ve now become proactive in your future success!

3. Evaluate and adjust your spending to match the 50/30/20 rule: Now you’re clued in to see how much money goes toward your needs, wants and savings each month, you can start to adjust your budget to match the 50/30/20 rule. The very best way to do this is to assess how much you want to spend on your wants every month. Create a spreadsheet using Microsoft Excel, Google Sheets or Apple numbers. They offer templates to make easy even for the novice. You can find plenty of free online 50/30/20 rule spreadsheets that are compatible with whichever program you’re using.

Remember your parents sitting at that kitchen table. Now see yourself with a solid game plan that has been proven to work. Let the past go and move forward with confidence and peace!

.png)

Comments